The Black Case for Bitcoin

We are in a moment.

For the first time in history, Black Americans have direct access to generational wealth without needing to rely on the permission of an incumbent authority. Bitcoin and Black America are writing parallel stories, fated to complete the hero’s journey on its highest difficulty level. Publicly ridiculed yet privately admired, a symbol of freedom yet sought to be controlled, elegant in design while still grossly undervalued.

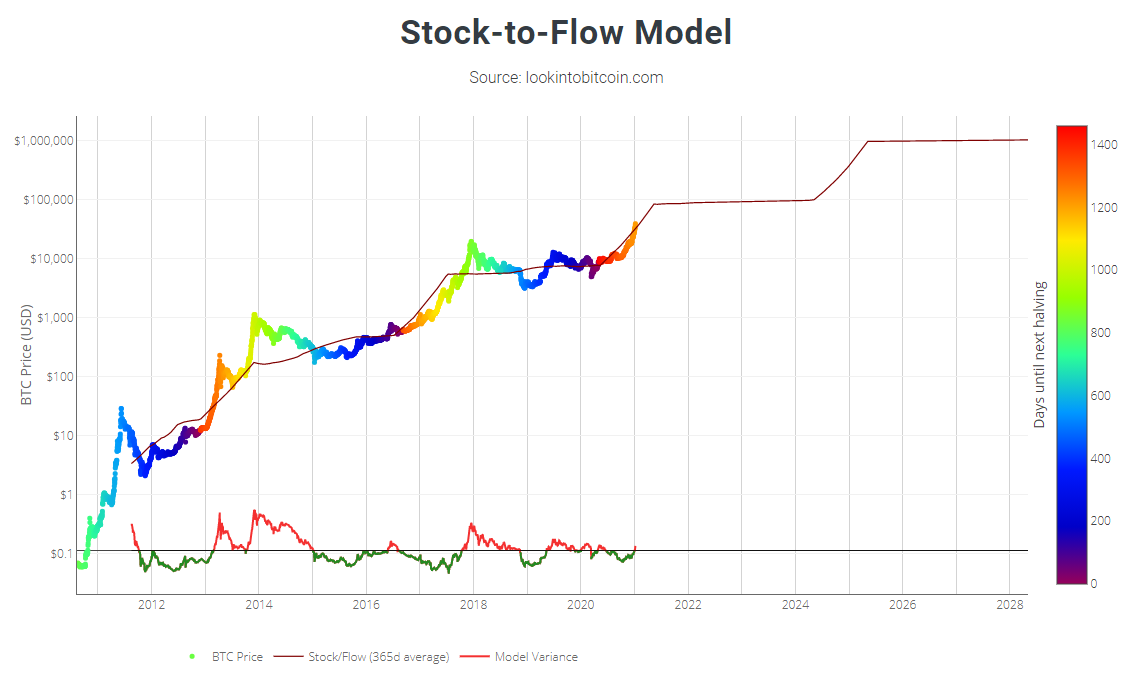

They either don’t know, don’t show, or don't care about our clear ability to produce asymmetric returns. When following basic technicals, estimates indicate that Bitcoin should be worth $400,000 today. The cryptocurrency derives value from its programmed scarcity, which can be plotted on stock-to-flow models. There will only ever be 21 million Bitcoin mined on planet earth, 18.5 million of which have already been accumulated by the globe’s first actors.

If any single group could understand this asset’s plight and potential, as they understand themselves, it should be us.

Don’t trust, verify

Bitcoin is the first-ever fixed supply, full consensus distributed ledger. Paralyzing in verbiage, digestible in concept. It’s a system that requires the agreement of all computers within its network to verify each and every transaction. Meaning, no gatekeepers validate or are involved in any peer to peer agreement.

As a global community, we validate each other’s transactions, this is done through BitcoinCore. To hack or manipulate a single transaction on the network you would have to deceive all of the hundreds of thousands of computers running the network around the globe, simultaneously, at once. Good luck.

To become one of the security computers that help fortify the network, no permission is required. You and I can be validators today within 10 minutes of setup. Traditional centralized institutions like central banks, particularly the Federal Reserve, control the rate of money supply and where it flows through our economy, without our say, in perpetuity. Accounting for the often pernicious nature of unchecked control, Bitcoin was created as a globally accessible alternative that places financial autonomy in the hands of sovereign individuals, instead of in the trust of any sole intermediary.

Not your keys, not your coin

Why is an open and permissionless system more preferable? To avoid gallows humor, there may not be a more perfect group to exemplify just how coercive unchecked power can be.

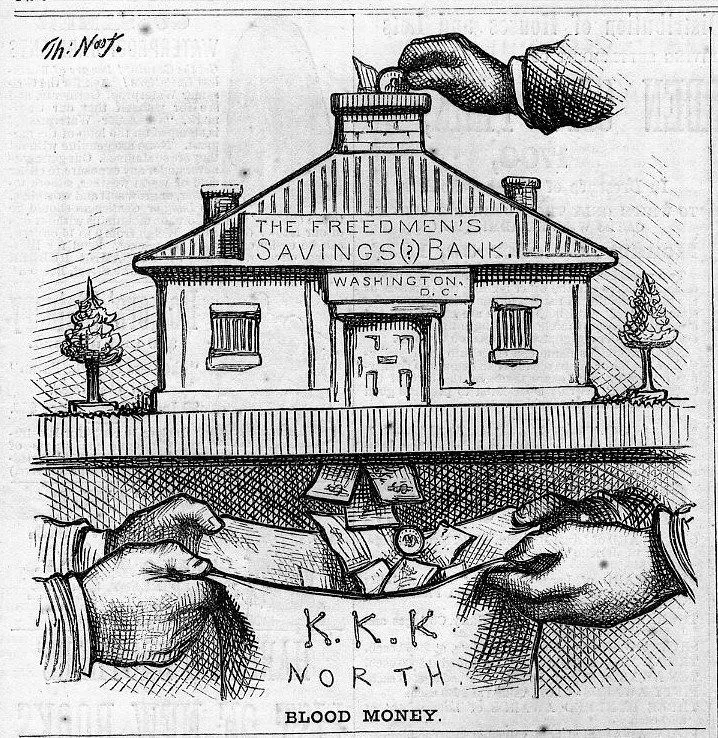

The first break in trust among Black Americans towards financial institutions stems back to the beginning of our independence. In 1865, Freedmen’s Savings Bank, the first and only federally created savings institution, was tasked to safeguard and manage the wealth of newly emancipated Black Americans. Within ten years, the bank handled more than $75 million in savings that belonged to former slaves, estimated to be worth $5 billion today. In that time, led by a white-controlled board, the bank slowly shifted from a prudent long term savings institution to a fund for reckless, high-risk speculation. The temptation was too much. By 1873, more than half of all of Black Americans’ wealth was overleveraged and mismanaged away. After continuous high-risk losses in real estate, railroad speculation, and blatant plundering, Freedmen’s Bank closed indefinitely with no avenue for freed slaves to recoup the billions lost.

And the suppression continued: mainly through the wealth-crippling effects of redlining and zoning practices which strategically directed public funds away from our communities. Through FHA, wealth-generating assets like mortgage credit were disseminated throughout many rural and suburban districts, yet largely bypassed zones in urban areas. While social welfare programs like the New Deal ensured “greater security to the average man”, Black America was largely excluded from the same relief and recovery that successfully helped pull the rest of the country’s middle class up by their proverbial bootstraps.

However intentional, Black economic disempowerment has been a central and plaguing feature throughout the entire development of American monetary policy. We were never given reason to trust them in the first place, and with that, we lived the philosophy that inspired Bitcoin’s creation.

The next phase

A world must exist where what was done to us, can not be done to another. Unlike in our history, technical advances now provide us with a choice to peacefully opt-out of a suboptimal, predatory legacy system. The network itself cannot be hacked, controlled, canceled, or regulated by any foreign or domestic body. But one of the few remaining elements that must fall into place for this project to become a success, is something we as Black Americans have massive leverage in — cultural adoption.

But before we get there, what up to this point have we overcome?

Institutional adoption

Until recently, acceptance from big money institutions was among Bitcoins' largest hurdles. The asset itself walked through the classic textbook gauntlet of being an “over”-achieving minority. Blatant disregard of high performance, fear-mongering tactics, the need to control its body, and eventually, when none of the above prospered, a reluctant buy-in.

In 2017, JPMorgan Chase’s CEO Jamie Dimon declared that he would fire any employee that was found trading the “fraud” digital currency. Fast forward three years later, the bank opened its services to bitcoin-holding clients and is currently projecting a $146,000 price today. PayPal opened crypto payments to its 487 million customers, and then bought 70% of all newly mined Bitcoin four weeks later. Recently, investment firm Greyscale bought three times the amount of Bitcoin mined in all of December, holding $20 billion worth today.

One competitive advantage that has drawn investment institutions over in droves is the blockchain’s sheer availability. Unlike traditional exchanges that are open from 9:30 a.m. to 4 p.m, and closed on weekends and holidays, Bitcoin exchanges are always open 24/7, 365; making any time of the day a profit opportunity. Case and point, recently Bitcoin traded at an All-Time high breaking $33,000 in the first week of 2021 while almost all other markets were closed that weekend. As a great philosopher and wise sage once said:

And everythings cool in the mind of a gangsta

Cause gangsta-a** ni**** think deep

Up 365, 24/7

Cause real gangsta-a** ni**** don’t sleep

In 2020 the debate was concluded: institutions are officially in. The smartest people in the room have already bought massive amounts of Bitcoin without alarming mainstream outlets. Now, it’s about figuring how to fit a crowd of elephants in a 21-square- foot bathtub.

There are simply not enough coins to go around.

Cultural adoption

For Bitcoin to succeed on a global scale, our relationship with the currency must be symbiotic. What it lacks, we have in abundance: cultural relevance.

Black America is often burdened with being society’s tastemakers, originators, and truth-tellers. Globally, we have the most dominant and exported music, sports, social movements, and entertainment. It ain’t cool unless we touch it.

That means Black artists, entrepreneurs, activists, scholars, professional athletes, and leaders need to exercise their coveted positions of influence to drive mainstream acceptability.

Athletes

Follow the lead of Carolina Panthers’ offensive tackle Russell Okung. He worked out a deal to be paid 50% of his $13 million dollar contract in Bitcoin for use as a wealth preservation tool. Note: if you take the asset inflation rate and subtract it from your nominal yield, the real yield on cash this year is roughly -25%. That means if Russell had not put $6 million into Bitcoin, he would have lost $3.2 million in purchasing power by the end of next year. If you’re among the highest-earning professionals in the world, you know that it’s key to preserve your family’s wealth. Think about putting at least 5% of it into bitcoin. Contact Spikes CEO Jack Mallers to get onboarded on the process — his company finalized the agreement with Russell.

Entrepreneurs

Follow the lead of Michael Saylor, Chief Executive of Microstrategy, and Jack Dorsey, Chief Executive of Twitter, CashApp, and Square. To date, Michael Saylor has bought 70,470 Bitcoin (nearly $1.596 billion) currently held in Microstrategy’s treasury reserves. Microstrategy is among the growing number of companies that believe Bitcoin to be a more substantial hedge against accelerated inflation than any other sound money asset, including gold. Likewise, Square placed 1% of its total assets into Bitcoin worth more than $50 Million. Bitcoin’s competitive advantage over gold lies in its fixed-supply scarcity, portability, divisibility, verifiability, and censorship-resistance.

Gold’s market cap currently sits at $10 trillion, Bitcoin $600 billion. Bitcoin has room for a conservative 20x from prices today, in order to reach Gold’s market cap. I’ll let you do the math, or get help here. Chief Executives should think about putting a bare minimum of 1% of their treasury reserves into Bitcoin and leave it be. Follow Micheal Saylor’s method to learn how to buy large quantities without moving the market, he’s sharing his playbook with CEO’s. Executives should also consider opening cryptocurrency investment options and retirement plans for employees. Savvy candidates are looking to work for companies that can identify and be ahead of the curve in economic trends. Making a treasury reserve commitment and providing employee options will establish a company as industry leaders in innovation, attract higher-quality candidates, and provide asymmetric return potential to your shareholders.

Scholars

The key is advocating growth opportunities in decentralized systems, hosting seminars on blockchain development, fintech services, and security. The University of Wyoming is among the earliest to establish Blockchain and digital innovation labs after the state became the first in the U.S. to approve a banking charter for digital assets. HBCUs are now offering crypto programs and many top universities are paying students to build out the blockchain.

Artists

The globe's most powerful influencers. Meg Thee Stallion recently threw a million-dollar bitcoin giveaway to help generate engagement with her fans. Another option is to collaborate with innovative businesses within the space, ones particularly focused on celebrating Black art through future mediums. One / OFF and Super Rare are at the forefront of this digital art movement, showcasing and selling NFT art for thousands of dollars in virtual display rooms. The future we imagined is already here and happening. Therefore, establishing a cultural footprint will be foundational to how this space develops and grows.

Our digital counterpart

The journey, ethos, and success of Bitcoin are archetypically tethered to the story of Black America. We see the power structure for what it is, and our mere survival is an act of defiance. And in doing so, we’ve turned our strange fruit into ambrosia from which the open-world nourishes. Both seeking to unplug from the same system that continuously tries to discredit our legitimacy. Protected and powered by a code more sound and fundamental.

And in that inheritance, we are one.

“Damn it feels good to be a gangster”