NIGERIA GOVERNMENT OFFICIALLY LEGALISE THE USE OF BLOCKCHAIN : WHAT DOES IT MEAN FOR BITCOIN ?

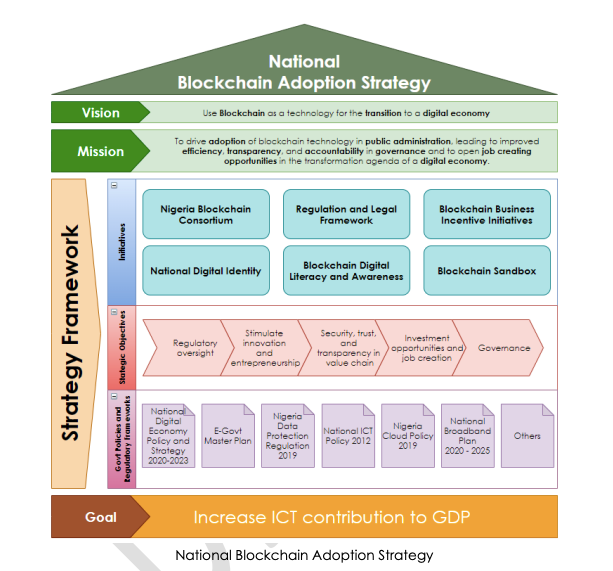

On the 3rd of May 2023 during the “Federal Executive Council” meeting, presided over by President Muhammadu Buhari (GCFR) at the council chamber, Presidential Villa, Abuja. The Nigeria Government approves the official use of Blockchain technology in the country. A development that became public after the Minister of Communications and Digital Economy, Professor Ali Isa Pantami, disclosed the official approval of “The National Blockchain Policy for Nigeria” to newsmen in Abuja after the meeting on Tuesday. He stated that the “the new policy was a product of consultations with 56 institutions and personalities whose end goal is to institutionalise blockchain technology in Nigeria’s economy and security sectors”.

Taking a deep dive into understanding the disposition of the Nigeria Government towards Blockchain dependent innovations over the years will paint a clear picture of how crucial and important this recent policy and federal approval is towards the Blockchain space in Nigeria and Africa at large. On the 12th day of January 2017, the Central Bank of Nigeria issued a circular with ref: FPR/DIR/GEN/CIR/06/010 where Other Financial Institutions (OFIs), Deposit Money Bank (DMBs), Non-Bank Financial Institutions (NBFIs) and the general public were cautioned on the risk associated with Blockchain dependent frameworks such as cryptocurrencies. Building on the previous warning & directive, on the 5th of February 2021, the Central Bank of Nigeria officially bans and prohibits banks from facilitating any Bitcoin and crypto related transactions. A ban that remains unreversed as at the time of writing this content. Not only does the restrictive policy come at a time when adoption of Blockchain, Bitcoin and Shit-coins related activities was on the rise in Nigeria, but it was a restriction that further fuelled the use of Bitcoin & Stable-coins as user who are wallowing in pains of financial restriction increasingly discovered more features such as Peer to Peer (P2P) marketplace that exchange and other Blockchain focused products offers. A feature that rendered the February 5th 2021 ban useless as the off-ramp and on-ramp payment activities were facilitated peer to peer.

Amidst all these initial impromptu Blockchain regulatory measures, the Central Bank of Nigeria was busy creating what was considered an alternative to shitcoins, a government controlled digital currency called e-Naira which was officially launched on the 25th of October 2021 , unequivocally built on centralised blockchain & not a Distributed Ledger Based or decentralised blockchain like Bitcoin, while the country’s Security Exchange Commission was occupied with creating policy frameworks for Token issuance platforms and Exchanges, which eventually became the regulatory measure being followed in relation with the issuance of Virtual Asset Service Provider(VASP) License , exchange and custody of digital assets in the country since it introduction on the 14th of May 2022 till date. All these are not unconnected to the government's awareness about how thriving the Blockchain industry is, in Africa’s most populous country.

One will ask what exactly does the “National Blockchain Policy” mean for Bitcoin, and all Blockchain dependent innovations in Nigeria ?.

A quick but detailed response will be, this is definitely a welcome development and one of the possible many steps we might witness in the right direction subsequently in Nigeria Blockchain space. This policy is focused more on giving a direct overview to relevant government regulatory bodies such as NITDA, CBN, SEC, NCC, and NUC, among many others who are now expected to develop appropriate usage & more detailed regulatory frameworks. Although, crypto and all other development instances and products dependent on the blockchain excluding Bitcoin stand a chance to remain regulated and subjected to all directives of these incoming regulations from each of the aforementioned agencies while Bitcoin uniquely repels regulations contradictory to its exclusively pre-programmed governing mechanism. This Nigeria Blockchain policy won’t elude or fail to regulate products offering Bitcoin as a service while Bitcoin as an innovation sticks with its core consensus mechanism ( POW ) as the only recognised rules and regulation. Five Bullet points to further elucidate this and what it means in layman terms.

- It means Bitcoin remains unregulated and can’t be intrinsically regulated except through the 51% attack clause which looks technically impossible to get triggered by any individual, agency or nation-state.

- It implies that any digital asset companies/products must register with the Security Exchange Commission (SEC) and it’s mandatory for them to follow all digital asset offerings and investment policies in compliance with SEC’s directive.

- The government is moving from being totally repellent and being antagonistic about Blockchain, Bitcoin and Crypto related activities to accepting and creating a regulatory environment to curb infiltration of scandalous blockchain based projects and fraudulent use of the technology.

- Bitcoin & Crypto related transactions are considered legal and officially known to be in existence by the government but won’t be facilitated by traditional banks answerable to the Central bank of Nigeria.

- As a stakeholder in the African Bitcoin space, I must confess that consistent clarity from the government will not only help in driving adoption but also create an enabling environment for Nigerians to incorporate decentralised blockchain technology (Bitcoin) into scaling their business, way of life while opening numerous legal opportunities for everyone.

As the industry keeps shaping up, keep tab on the space as Nigeria President Elect Asiwaju Bola Ahmed Tinubu promised in his manifesto to enable the prudent use of blockchain technology and cryptocurrencies in the nation's banking and finance sector while assuring the establishment of an advisory committee to review the existing Security Exchange Commission (SEC) regulations on digital assets with the aim of making them more business-friendly. Fingers crossed till we experience the full implementation.